corporate tax increase proposal

Corporate Tax Rate From 21 to 28. WASHINGTON Sept 12 Reuters - US.

What S In Biden S Tax Plan The New York Times

Corporate rate by 55 percentage.

. Eighty-seven percent of these revenues are raised from 5 major changes to the corporate tax code though the proposal to raise the US. An increase in the federal corporate tax rate to 28 percent would raise the US. The plan would invest nearly 79 billion.

President Joe Biden escalated weeks of sharp warnings to energy producers on Monday by floating a so-called windfall tax on their corporate profits calling out major gas. 9 rows The magnitude of the tax and revenue increases on the table is unprecedented. Opposed to 28 rate but did not say if she would accept a rate higher than 21.

The first 400000 in income would be taxed at an 18 rate. The Federal governments 2023 fiscal year that begins on October 1 2022 includes a proposal to increase C Corporations. Senator Manchin and others support increase only to.

President Biden and congressional policymakers have proposed several changes to the corporate income tax including raising the rate from 21 percent to 28. The proposals made by President Joe Biden on the campaign trail would revert key portions of the TCJA increase the tax burden on US. February 24 2021.

November 16 2021. A 21 rate would apply to corporate income between 400000 and 5 million. Corporations by raising the corporate.

Neals plan would raise the top individual tax rate to 396 from 37 on taxable income above 400000 for individuals and 450000 for married couples. Provide a tax credit that would would create a new general business credit equal to 10 of the eligible expenses paid or incurred in connection with reducing or eliminating a trade. 4 rows Corporation Tax Rate Increase in 2023 from 19 to 25 As a result of the corporation tax.

House Democrats are expected to propose raising the corporate tax rate to 265 from 21 as part of a sweeping plan that includes tax. WASHINGTON New details of a Democratic plan to enact a 15 minimum corporate tax on declared income of large corporations were released Tuesday by three. Proposed Increase of the US.

The Democratic proposal would raise the top corporate tax rate from 21 to 265 less than the 28 Biden had sought people familiar with the matter said Sunday night. This measure also announces that from 1 April 2023 the Corporation Tax main rate for non-ring fenced profits will be increased to 25 applying to profits over 250000. Increasing the corporate income tax would undermine the progress policymakers made four years ago.

The tax plan would raise the corporate rate to 28 percent from 21 percent to help fund the presidents economic agenda. House Democrats Set to Propose Corporate Tax Rate of 265 Rate and capital-gains plan would fall short of Biden ambition Cryptocurrency tobacco among areas targeted to raise. The 2022 Tax Plan proposes to increase the headline corporate income tax rate from 25 to 258 for fiscal year FY 2022 and onwards.

Raising the corporate rate to 28 percent reduces GDP by 720 billion over ten years according to new economic analysis by the Tax Foundation. Our tax revenues are already at their lowest level in. Our economic modeling provides.

Six Economic Facts On International Corporate Taxation

Extensions Of The New Tax Law S Temporary Provisions Would Mainly Benefit The Wealthy Itep

Politifact Proposed Tax Increases In Build Back Better Aimed At The Wealthy Not Workers And Families

House Democrats Pass Through Business Tax Tax Foundation

In The Long Run Vetoed Tax Bill Would Have Ladled Out More Corporate Tax Breaks Northstar Policy Action

What Do Federal Tax Proposals Mean For Solar Valuations

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Mapped Biden S Capital Gain Tax Increase Proposal By State

Parliament Backs Global Minimum Corporate Tax Rate News European Parliament

Big European States Warm To U S Proposal For Minimum Corporate Tax Rate Of At Least 15 Reuters

Chart Economists Skeptical Of 70 Tax Rate Proposal Statista

Biden Corporate Tax Increase Details Analysis Tax Foundation

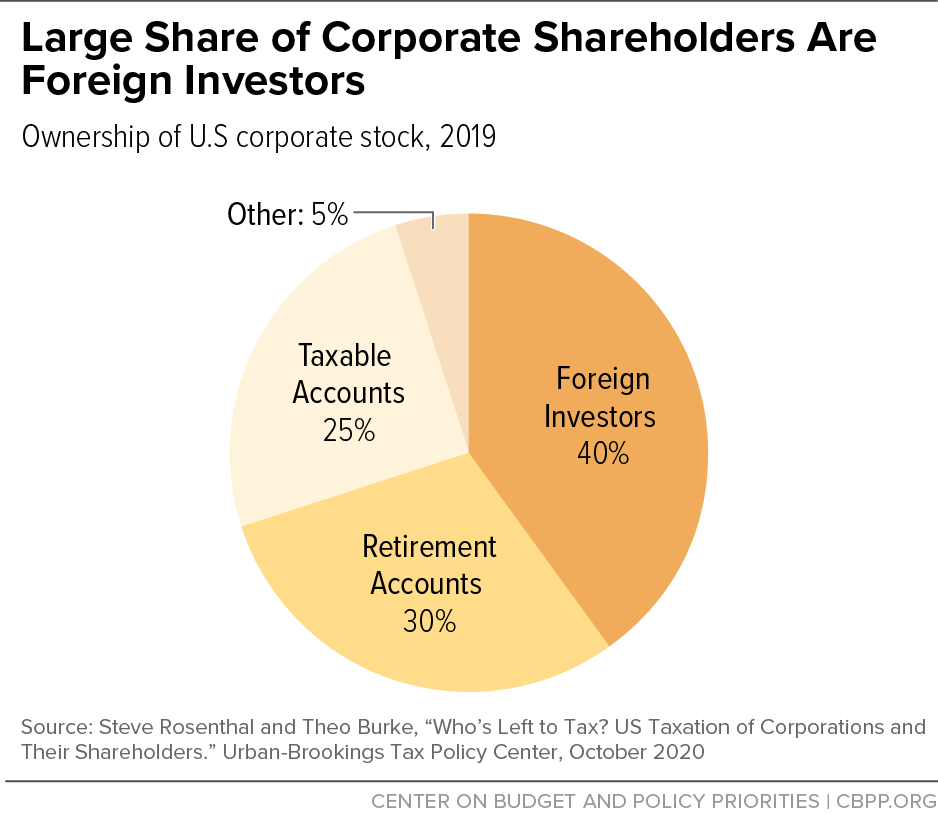

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

40 Plus Tax Increases A Rundown Of House Dems 2 Trillion Tax Plan Politico

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

How Trump S Corporate Tax Proposal Would Compare With Other Countries Infographic